Oasa‘s Rise and Wipeout

Published:

Hey, I’m Yong, a robotics exec with over 20 years crushing it in robotics, automation, and IoT, steering global teams to build game-changing products that push boundaries. As a founder and tech nerd, I’ve been in the trenches—launching startups, navigating the chaos of innovation, and driving high-impact solutions that stick. The robotics world’s buzzing right now with Physical AI hype, but it’s a brutal game where survival’s the first win. When I saw Oasa’s epic rise and brutal crash, it hit home—been there, felt that. Let’s dive into their story, unpack what went down, and drop some hard-earned wisdom on how to play the robotics startup game without wiping out.

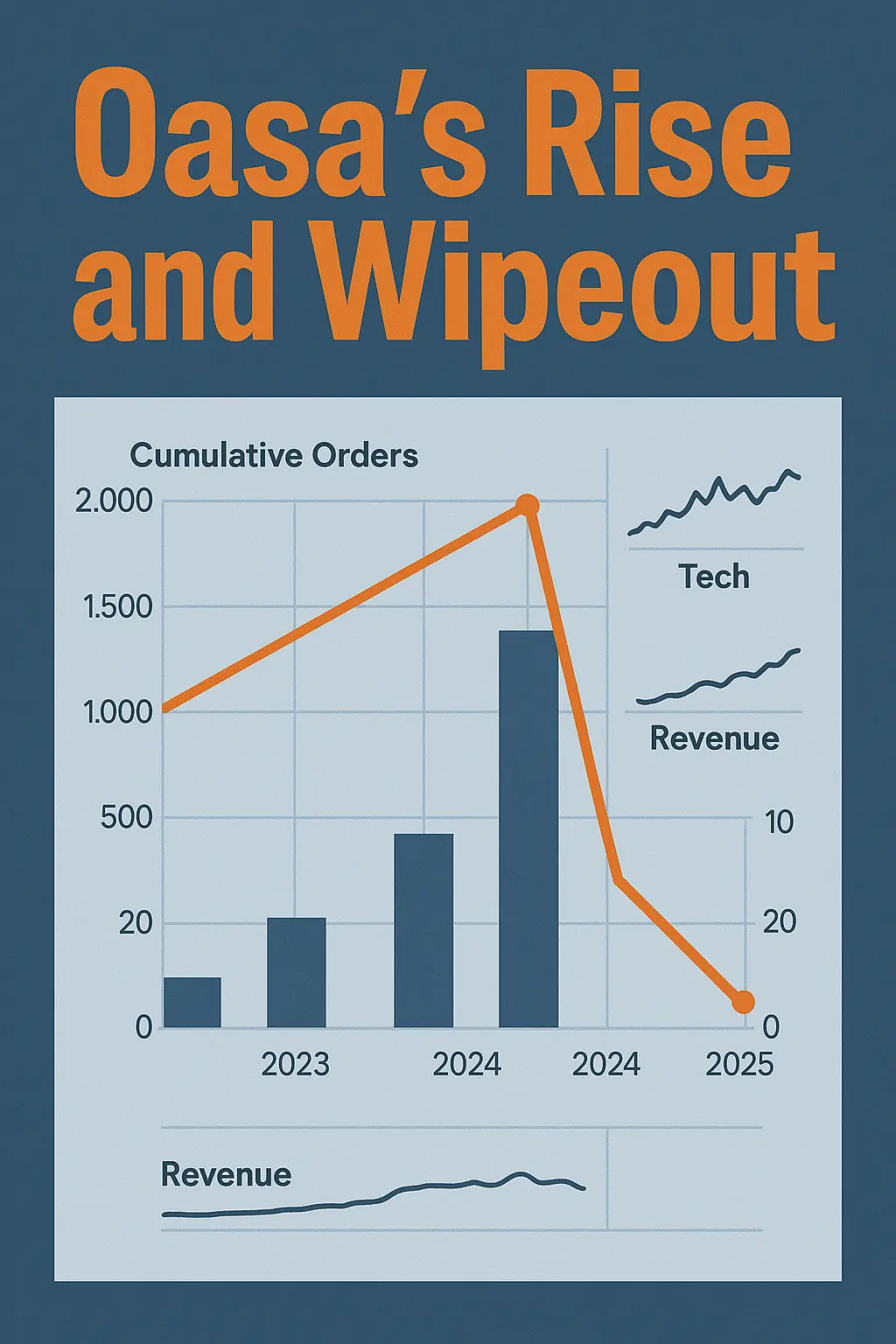

Oasa, a lawn-mowing Chinese robot startup launched by Li Chang in 2022, crushed it early, snagging CN¥100M in angel funding and $2.3M on Kickstarter (1,790 backers) in under three years. Their flagship, the Oasa R1—the world’s first reel-blade robotic mower—dropped in June 2024, targeting the U.S. and Germany with killer cutting precision and low-maintenance vibes. First deliveries hit in December 2024, but just six months later, Oasa tanked in May 2025, crushed by team chaos, production bottlenecks, and a dried-up cash runway. Li Chang dropped an open letter admitting the operational and financial stress was too much, and the shutdown was announced out of nowhere at a morning stand-up—total gut-punch. Only 20-30% of crowdfunded orders (like 350-500 units) shipped, Amazon’s sales channel ghosted, and over 100 user complaints flooded socials. Li’s vowed to explore ways to keep the project’s legacy alive, but Oasa’s crash is a loud wake-up call for the robotics game: you gotta stay alive to disrupt.

I totally get Li’s struggle—it hits close to home. Back in 2018, I kicked off an industrial IoT startup, also gunning for the U.S. and Germany markets. We burned a year in 2019 building out hardware and software, started shipping small batches early 2020. On January 20, I was wheels-up to Germany and the U.S. for biz dev, but then the pandemic locked everything down. Team drama, production hiccups, and cash-flow nightmares killed the dream. Unlike Oasa, I didn’t have a $14M war chest—most of our funds were bootstrapped, with a sliver from investors. Running a B2B play meant 6-12 month sales cycles, which bled us dry. That crash taught me hardware startups are a beast, and survival’s the name of the game.

With Physical AI blowing up, robotics startups are the hot new thing. As a 20-year robotics vet and 5-year founder in robotics, AI, and IoT, here’s my breakdown of Oasa’s wipeout with some hard-won lessons.

Oasa went all-in on a LiDAR-vision system and reel-blade setup for the Oasa R1—super innovative, but pricey. LiDAR modules run $200-500 a pop (industry estimate), way more than $50-100 for vision-only systems. Reel blades cost 2-3x more than rotary ones (~$100-150/unit) due to precision machining. They couldn’t scale production to hit a profitable $1,199 price point (needing 30-40% margins). Hardware startups gotta balance moonshot tech with grounded costs. Building one solid unit isn’t the same as pumping out 10,000. Oasa’s team probably lacked the mass-production chops to keep costs in check. Nail manufacturability early, focus on cost-optimized MVPs over feature bloat.

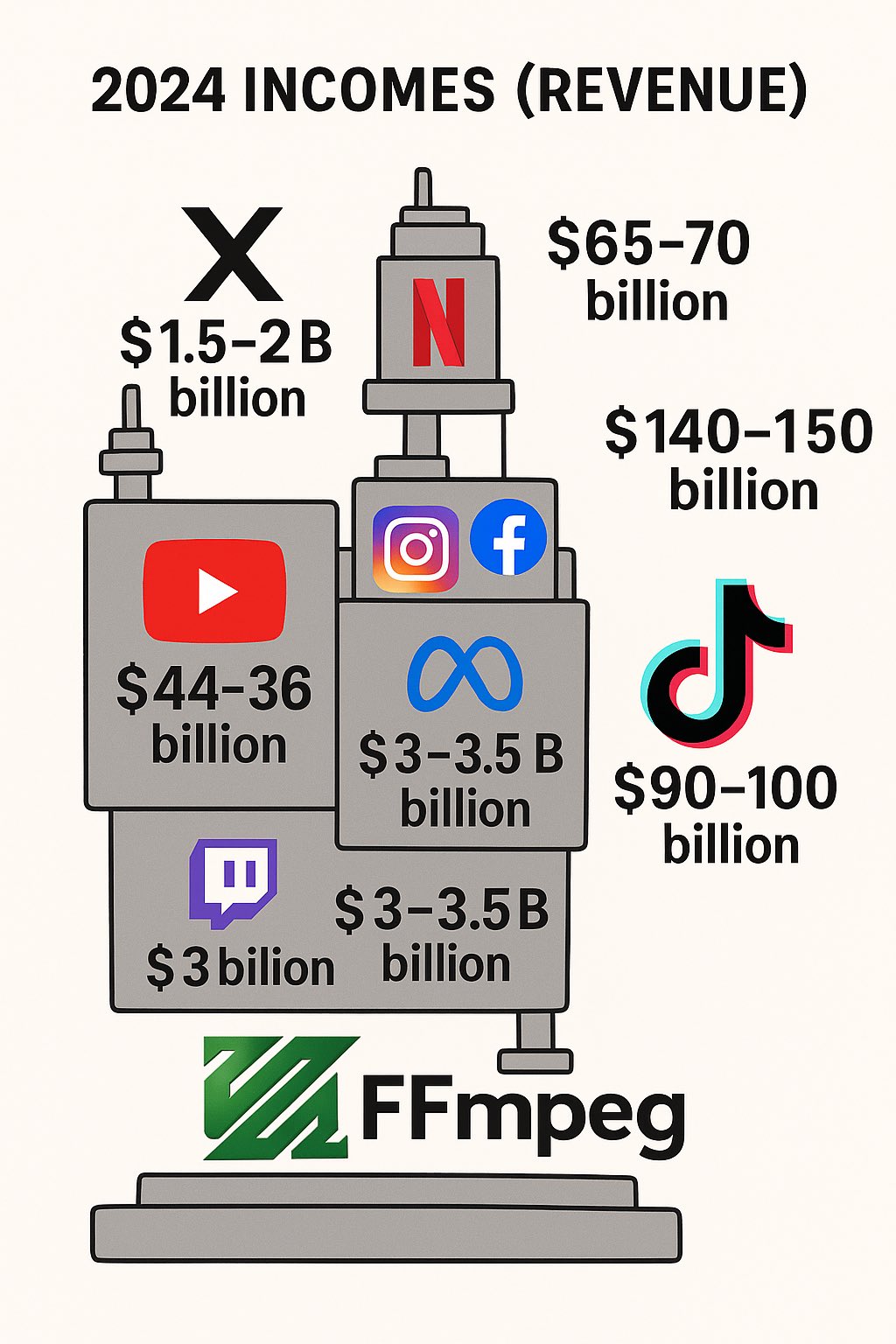

The Oasa R1 capped out at 1,500 m² lawns, but U.S. suburban yards average 2,000-5,000 m² (Frost & Sullivan). Competitors like Segway handle 3,000-10,000 m². Oasa’s 1,790 Kickstarter backers paled next to MOVA’s 5,000+ (Kickstarter estimate). You gotta know your market cold. Oasa’s premium pitch was cool but missed the broader need for versatile, affordable mowers. Robotics is full of tech that’s dope but doesn’t sell. Tech and revenue are different beasts—FFmpeg’s awesome, but TikTok and YouTube are the ones banking billions ($90-100B and $44-36B in 2024, see chart). Nail your biz model and market fit to turn innovation into cash.

Going from prototype to mass production is a startup’s make-or-break moment. The Oasa R1’s reel-blade system needed high-precision CNC machining, with early yields likely under 70%, jacking up costs by $50-100/unit. Oasa shipped only a few hundred units against 1,790 crowdfunded orders—supply chain fail. Hardware’s brutal—one bad part can restart your whole testing cycle, eating time and money. Partner with legit contract manufacturers early and build a bulletproof supply chain. Oasa’s bottleneck is a classic startup pain point.

Oasa raised approximately $16.3M (~$14M angel + $2.3M crowdfunding), but crowdfunding likely netted 80% ($1.84M), 5% for KickeStarter, and 15% for others like marketing. Robotics startups burn $5-10M a year, and Oasa blew through their cash in 2.5 years ($540K-$1.08M/month), with no follow-on rounds. R&D, manufacturing, and marketing eat cash before revenue kicks in. Team turnover and production delays made it worse. Hardware founders need tight milestones and ruthless cash-flow management to avoid running dry.

In a B2C play, crowdfunding’s your cash and your hype machine. Oasa pulled $2.3M from 1,790 backers ($1,285 average), but only shipped 20-30% of orders (350-500 units). Amazon’s channel vanished, sparking 100+ social media complaints. B2C lives or dies on customer trust. Oasa dropped the ball on transparent comms—like not updating on delays or refund plans—tanking their rep. B2C brands need conservative timelines (add 6-12 months) and constant updates (weekly emails, anyone?). Oasa’s fumble shows that screwing crowdfunding kills short-term sales and long-term loyalty.

There’s 250M yards globally, 2/3 in Europe and the U.S. (Frost & Sullivan), with mower bots at <10% penetration—a $10B+ market waiting. Chinese players like Ecovacs and Ninebot are killing it, with 200-400% order growth in Europe (2025). But the game’s cutthroat—30-40% of startups crash. Only those with sustainable models and operational hustle survive the shakeout. Hype brings players, but execution wins.

Oasa’s crash teaches hard lessons: 1) Simplify designs to cut production costs 20-30%; 2) Validate market fit in 6-12 months; 3) Build supply chains with <5% delay rates; 4) Treat crowdfunding like a sacred promise with proactive comms.

The startup game’s about staying alive. Robotics throws tech, market, and cash hurdles at you—survive the “valley of death” to build something epic.